Asset-Based Lending vs. Venture Debt, Demystified

Addressing a question we get from founders and investors all the time

When we asked ourselves the most common questions we hear in first meetings with companies, one in particular stands out: “is this like venture debt?”

Venture debt is a nebulous term that means different things to different people. Pitchbook simply categorizes venture debt as debt raised by startups. We think this obfuscates the story, and can be confusing for founders who are seeking out the best ways to fund their businesses. Add on that lenders haven’t done the best job of demonstrating how debt can be used by startups and small businesses to finance growth and solve problems, and it becomes pretty clear why we get asked this a lot.

Asset-Based Lending 101

Asset-based lending (ABL) is when companies raise capital by pledging hard assets with resale value or cash flowing assets like loans, receivables, or other contractual cash flows. For example, a powersports financing lender like Octane uses asset-based lending facilities to help consumers finance their snowmobile purchase. Or an online car purchasing platform like Clutch uses asset-based lending to fund the purchases of their vehicle inventory, which they in turn sell to end customers. Even a clean energy generation company like Crusoe could use asset-based lending to finance the generators required to capture flare gas from shale mining to capture excess energy which can be used to power bitcoin mining, cloud computing, or other high intensity computing operations that require a lot of energy.

ABLs are a powerful tool to help companies with stable parts of their business and identifiable collateral or cash flows to finance growth more efficiently and with less dilution. The market is large and growing, particularly as banks have stepped away from much of the private credit ecosystem following the 2008-09 global financial crisis and, more recently, the regional bank challenges in the US and Europe.

According to a recent report from KKR, the private global asset-based finance (ABF) market totals $5.2 trillion. That figure is 15% larger than it was in 2020 and 67% larger than at the pre-GFC peak of $3.1 trillion in 2006. On top of that, it’s projected to grow to $7.7 trillion over the next five years.

Source: KKR

Venture Debt 101

On the other hand, venture debt is ultimately an exercise in underwriting a cap table. When offered by a bank, it has often been used as a wedge to cross-sell other banking products, namely deposit accounts. When a company raises a $10M Series A from a high profile venture capital firm, venture debt lenders might offer $3-4M in debt to extend the runway. Companies can use the debt for general corporate purposes (read: anything), but they agree to repay the lender once they raise their next round (read: the loan is repaid with future venture equity dollars).

This was a great trade for lenders and founders over the past decade, as the risk free rate was effectively zero and the markets were awash in venture capital dollars. But the Fed raising interest rates and the massive pullback in venture capital at all stages has meant the cost of capital has gone up and the agreement between venture debt lenders and founders is much less certain. Will the company be able to raise their next round of equity and pay back the loan? That answer is increasingly unclear.

Why Asset-Based Lending

One word: alignment. From the onset, Upper90 has been based on the belief that non-dilutive credit was a key piece missing in the startup world. The explosion in data is a key component of this strategy. It enables startups to access credit earlier for the healthier parts of their business, such as inventory, equipment, acquisitions, receivables, and even marketing. As soon as businesses become de-risked, the goal of growth equity firms is to invest as much capital as possible. With that comes greater dilution and potential for adverse incentives, compelling companies to grow faster than they’re ready to at a point in time. For the right businesses, diversifying your capital sources beyond equity enables founders to finance facets of their business more efficiently without relying on incremental equity dollars in perpetuity.

A fundamental premise of asset backed loans is that they can pay themselves off by selling, running off, or recapitalizing the pledged assets. Venture debt, on the other hand, requires another equity round to be raised, which makes the debt heavily correlated with the equity outcome.

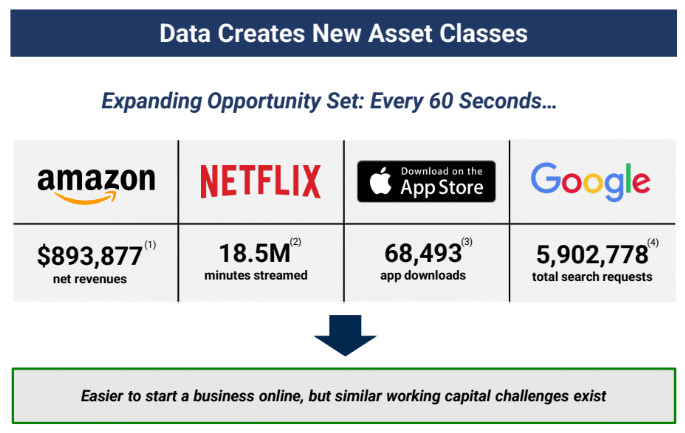

Sources: (1) Amazon 10-K, (2) Netflix 10-K, (3) Statista, (4) Google Search Statistics

Think of the internet marketplaces pioneered by Facebook, Amazon, Google, Netflix, Airbnb, and TikTok and the millions of businesses they have helped create on their platforms. While the operational infrastructure to launch and run a business is more seamless than ever, traditional capital is often still required to operate and grow the business. We often say that the capital infrastructure hasn’t kept up with technological infrastructure. These are areas in which we can help provide valuable liquidity to help businesses continue to scale without the founder selling a large stake in their company.

That brings us to our hybrid approach, with hybrid being a critical factor. We’re proud to have pioneered an investment model combining tailored credit and equity for alignment. We work closely with founders of fintech, commerce, supply chain, and marketplace businesses with positive unit economics and provide capital that helps them better control ownership without sacrificing growth. How we do this is by isolating healthy parts of a business for which equity isn’t the only/best source of capital.

Where Upper90 Fits In

At Upper90, we help startups delay, or even skip their Series A. That means founders and early backers don’t have to weigh a tradeoff between growth and dilution, and can instead finance a portion of the business earlier with debt. Much of this boils down to providing founders with optionality and multiple ways to win. Our credit commitment is for the current phase of growth, rather than an optimization exercise to lock up capacity long term. And in order to maintain our alignment with the founders we’re backing, we invest a smaller, yet still meaningful amount in the equity (10:1 ratio between debt-to-equity is the typical starting point). Since raising our first fund in 2018, we’ve become a leading provider of hybrid growth capital with $1.1B in regulatory AUM and nearly 50 portfolio companies.

If you’re a founder working on a business with a capital intensive element in fintech, supply chain, commerce, or marketplace, reach out to conor@upper90.io. We’d love to learn more about what you’re building.