Why We’re Doubling Down on FilmRise

Meet The Unicorn Creator Economy Platform Who’s Founders Own The Majority of The Business

Meet The Unicorn Creator Economy Platform Who’s Founders Own The Majority of The Business

Consumers have an unrelenting appetite for content. Americans increased their average weekly streaming consumption to 169 billion hours this year, up 18% from last year. The universe of streamers is growing, as are the mediums through which they can stream content. Over 65% of consumers pay for at least three streaming services; additionally, growing connectivity means we can watch content across different mediums - smartphones, TVs, tablets, computers, and internet connected devices like Roku or Apple TV.

The proliferation of data increasingly informs what, when, and how we consume content. If we were writing this article 20 years ago, we would be talking about licensing cable rights to blockbuster TV shows like Seinfeld or Friends. The abundance of data and hyper-personalization of consumer experiences has empowered long-tail content to thrive - this is precisely the insight FilmRise landed on in 2012.

Enter FilmRise: Premier Acquirer of Offline Content

FilmRise is an innovative Brooklyn-based media company that acquires the digital rights to niche TV / movie libraries and distributes them across OTT platforms like Roku, YouTube, Pluto, Amazon and FilmRise’s own streaming network. They are a dominant player in their industry and the largest independent provider of digital content to streaming channels.

Using proprietary analytics and algorithms, they can assess viewer demand, revenue potential, and ROI on individual content. By bringing latent content like Forensic Files, Hell’s Kitchen, and the Dick Van Dyke Show online, FilmRise can enhance content value by broadening distribution in a world of endless consumer demand.

Today, FilmRise has invested over $100M into its content library consisting of over 50,000 licensed and originally produced feature films and TV episodes. Their library includes the highest accolades spanning Emmy nominations, Tribeca Film Festival winners, and Sundance winners.

The fact that the founders reached unicorn status while continuing to own the majority of their business is equally as impressive. By accurately determining the future cash flows of specific content, they were able to secure debt financing in lieu of using equity like most other startups to acquire these under-the-radar but well secured assets. Upper90 was built around the thesis that data creates new asset classes. As early backers of FilmRise since 2017, we’re thrilled to expand our partnership in their most recent debt financing.

Owning the Long Tail in a Massive Market

The founders Danny, Jack, and Alan are veteran film producers with deep roots in the content ecosystem. Prior to founding FilmRise, Jack and Danny ran City Lights Media Group, a TV and film production and distribution company responsible for over 60 shows. Through their experience at City Lights, the team saw an opportunity to reimagine the way content is distributed.

They honed in on a thesis well ahead of its time: The opportunity coincided with a powerful tailwind: a rapidly growing market for digital advertising. The US digital ads market is expected to exceed $300B by 2025, growing 50% over the next four years. Meanwhile advertising-based video on demand (AVOD) revenues are projected to reach $70B by 2027 globally, up 133% from the $30B in 2021. The pace of growth, coupled with the proliferation of new streaming services, all play into FilmRise’s favor as the growth of AVOD and its dependence on advertising dollars means a growing addressable market.

Doubling Down on FilmRise

We first met the company in 2017 through one of our advisors who was considering an investment to help finance the acquisition of digital content. At the time the company was licensing content and releasing it primarily on Amazon Prime via a royalty per streamed hour arrangement. Instead of using equity to finance content acquisition, we participated in a credit structure that allowed FilmRise to pay for content upfront at low multiples and mitigate dilution meaningfully in the process.

Through our early relationship with Danny and the team at FilmRise, we were the first call when the company wanted to upsize their facility. We’re proud to deepen our relationship with FilmRise alongside MSD Capital in a senior debt facility to help accelerate growth and content acquisition.

“Upper90 has been an important partner over the last four years. They have repeatedly taken the time to understand the business and provide flexible capital to help us grow. We are excited to continue the partnership and any company that has predictable revenue should reach out to them.” - Danny Fisher (FilmRise CEO)

By leveraging credit early to finance the acquisition engine of their business, FilmRise was able to scale faster while taking on very little equity dilution. We’re proud to be partners with such a talented team and equally proud that we have helped the founders to own an outsized portion of their business. We believe those taking the greatest risk -- the founders -- should own more of the businesses they build.

Our Thesis on the Creator Economy

We believe the creator economy is one of the most dynamic and exciting opportunities in the early stage ecosystem. Through our partnership with FilmRise, we have had a first row seat to the growth and scale of this market. The three catalysts for our intrigue going forwarded are:

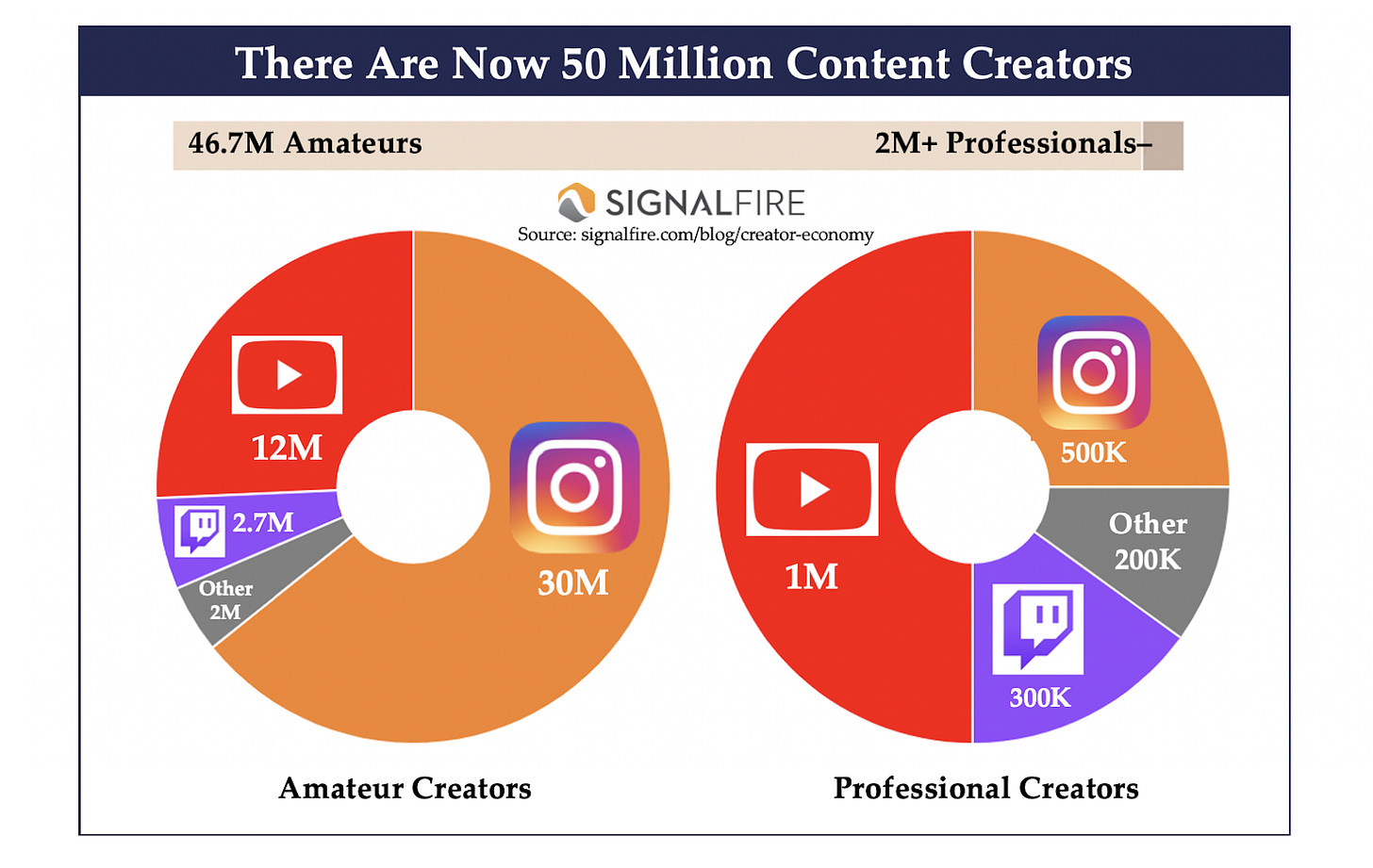

Untapped Market Size: These markets are bigger than people think. While there are an estimated 50M and growing, the vast majority of the market aren’t full time creators. Though less than 5% of the market is “professional”, we believe that number will only grow as tools for content creation, distribution, licensing, and monetization continue to expand. In the case of FilmRise, we often joke about how many times we think people could watch a Sherlock Holmes mini-series online? It turns out that number is a lot. We’re starting to see the emergence of companies like Jellysmack who are bringing de novo content from YouTube to new channels like Facebook, Instagram, Snapchat, and TikTok.

New Forms of Monetization: New innovations in creator monetization will make “creator” a full time career for more individuals. Historically, creators are reliant on platforms who take large percentages of creator earnings (30-60% on average). But some of the biggest innovations are happening in and around the new levers for creator monetization. Affiliate marketing partnerships with brands, affiliate links, tip jars, and branded content / merchandise are a handful of new forms of monetization. Companies like Willa and Archie are helping influencers and freelancers get paid faster, while businesses like Spotter are offering liquidity to channel owners. Companies like Pietra and Night Capital are leaning on creators as acquisition channels for leading brands.

Professionalization of Business Management: While the ability to start a business online is easier than ever, the job of managing that business is a different story. Advancements in financial operations, audience engagement, marketing automation, and working capital will fuel the next generation of creators. Companies like Karat, beatBread, and Pico are helping to professionalize the next class of businesses.

Why We’re Excited About What’s Next

Every minute, over 500 hours of content are uploaded on YouTube. YouTube paid out $6B to the music industry alone in the past 12 months, up 50% from the previous year. Mr. Beast employs over 60 people, looking more like a media company than an independent creator. Influencer marketing spend has more than doubled since 2019. We’re excited about the tailwinds and derivative opportunities stemming from this emerging ecosystem.

As the cost to create and distribute content has come down, what remains is the burden of running and scaling a business profitably. We believe we’re still in the first inning and are excited to back amazing founders building in the creator economy. We want to support the next great content acquisition and fintech platforms building tailored financial products for creators across banking, lending, payments, and software.

If you’re building in the creator economy and looking to scale with less dilution, we’d love to talk to you.