Why Alignment Matters in Credit

Delving into Upper90's core beliefs and how we align with the founders we back

Upper90 was built around the belief that data creates new asset classes, but less-dilutive credit to finance those asset classes has been largely absent in the startup world. To change that, we launched the firm in 2018 to offer founder-friendly credit earlier, helping businesses solve their most pressing capital needs while maximizing ownership and control.

Let’s dive into what exactly “founder friendly credit” means

Most startups don't think enough about debt as a source of capital to fund growth. In other posts, we highlight the role that debt can play in financing early stage companies more efficiently and with less dilution.

We believe the optimal outcome of any partnership between a portfolio company and Upper90 centers around three things:

Optionality: Providing founders with more ways to “win” from capital diversification. Meaning, operating a profitable business, selling for $100M, or going public at $1B can all be good outcomes. It shouldn’t have to be growth at all costs.

Ownership: Providing credit to stable parts of a company where that debt can more efficiently finance an asset or stream of contractual cash flows, rather than the default solve being equity and resultant dilution. When true, business execution and asset performance alone can determine the right time to raise future capital.

Flexibility: Giving founders the ability to operate (and sometimes, fail) in reality. Uncertainty in company building is one of the only certainties - things can and will break. Collaboratively working with companies to help solve growth challenges is paramount in any true partnership.

We aim to achieve all of this through alignment with the companies we back. We are primarily an asset-based lender, supporting early stage startups that have a capital intensive element of their business. We are best suited to be the first institutional credit partner. In this environment, we’re also seeing later stage tech businesses with shorter term and complex capital needs.

Irrespective of stage and size, we want to be on the same side of the table as the companies we back. To do that, we make smaller equity investments alongside our credit facilities to strike that alignment with our founders.

Show me the incentive, I’ll tell you the outcome

For traditional lenders, the incentives are ultimately around putting large amounts of money to work at a high cost of capital for as long a time as possible. When companies are early in their journey, they often have fewer credit options available to them. So they can, and often do, get locked into long-term lender arrangements. In many cases, we believe the goals of the lender are inversely correlated with the goals of the founders and their business.

Longer-term, these arrangements ultimately work against founders and the underlying business. For example, in fintech and supply chain finance, cost of funds is one of the most important variables in the unit economics equation. So the goal should be to build the capital markets muscle internally, refine an underwriting process, and hone in on product market fit. Subsequently, the next step should be accelerating the path to cheaper bank financing to unlock unit economics and de-risk the business.

Early in a company’s journey when cost of capital is typically higher, we believe founders should think about raising what they need for the current phase of growth, rather than trying to raise the maximum amount of capital they can find. Said another way, don’t look for $50M in credit when the business only needs $10M for the next 18 months.

What alignment looks like

We built Upper90 around the belief that debt and equity should be aligned. Simply put, a lender acts differently when they have skin in the game. As a result, we only support companies only where we have deep, long-term conviction in the team, business, and ability to execute. To reflect that conviction, we typically invest a smaller amount of equity alongside our credit facilities in the companies we back.

While long-term alignment means customer introductions, hiring support, capital markets advisory, and high fives when things are going well, it also changes the way decisions are made when things don’t go as planned. We spend a lot of time post-investment providing value beyond capital across go-to-market, talent, customers, and future debt and equity raises. Additionally, and sometimes more importantly, we help solve problems related to people, product, distribution, and economics when things aren’t going as well.

Returning to the things we look for in a successful partnership, optionality is critical.

We often spend time with founders digging into the use of proceeds for an upcoming fundraise - a slide in most fundraising decks. What we find in many cases is a bucket within that use of proceeds that has entails stable, predictable revenues and/or explicit collateral that can be underwritten and thus, financed with credit.

A common takeaway from these exercises is that founders are often raising more equity than they need, as there are facets of the business that are better suited for debt. Examples include hard assets like inventory, equipment, or vehicles with tangible collateral value. Others include financial assets like receivables, loans, leases, royalties, contracts, and other IP.

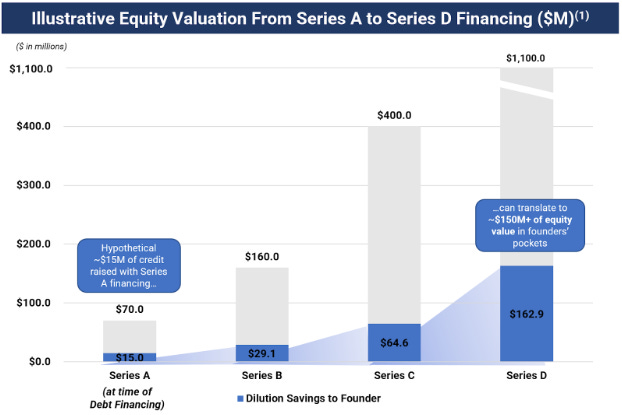

Our operating thesis at Upper90 is that it’s not how much you raise, it’s how much you own. We exist to help founders grow more efficiently with less dilution. That’s where ownership comes in. Those taking the greatest risks - the founders and team - should own more of their business. Raising the right mix of equity and debt help to optimize for efficient growth without sacrificing exorbitant dilution.

Sources: (1) Based on median valuation, round size, and dilution data across Series A to Series D rounds from Carta 2021 US VC report

Raising equity is an important input to financing early stage companies. We also accept that not all great companies are destined for hypergrowth. Founders and investors alike can achieve great outcomes without requiring unicorn valuations. While it may have been forgotten over the past few years, companies should ultimately be able to self-finance their own growth and control their destiny.

Our credit commitment is for the current phase of growth, rather than locking up capacity long term. We end up building deep long-term relationships with our portfolio companies through flexibility. Your next lender may be taking longer than expected to close. Customer demand may have grown faster than expected and you don’t want to risk turning away customers. You may have a new product launch or market expansion that requires a new credit facility. Having an aligned partner helps solve complex capital challenges.

If you’re a founder working on a business with a capital intensive element in fintech, supply chain, commerce, or marketplaces, reach out to conor@upper90.io. We’d love to learn more about what you’re building.

Notice to Recipients:

This document is for informational purposes only and should not be relied upon as investment advice. This document has been prepared by the Upper90 Capital Management and is not intended to be (and may not be relied on in any manner as) legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy any securities of any investment product or any investment advisory service. the information contained in this document is superseded by, and is qualified in its entirety by, such offering materials. This document may contain proprietary, trade-secret, confidential and commercially sensitive information. U.S. federal securities laws prohibit you and your organization from trading in any public security or making investment decisions about any public security on the basis of information included in these materials.

This document is not a recommendation for any security or investment. references to any portfolio investment are intended to illustrate the application of the Upper90 Capital Management’s investment process only and should not be used as the basis for making any decision about purchasing, holding or selling any securities. nothing herein should be interpreted or used in any manner as investment advice. The information provided about these portfolio investments is intended to be illustrative and it is not intended to be used as an indication of the current or future performance of Upper90 Capital Management’s portfolio investments.

An investment in a fund entails a high degree of risk, including the risk of loss. There is no assurance that a fund’s investment objective will be achieved or that investors will receive a return on their capital. investors must read and understand all the risks described in a fund’s final confidential private placement Memorandum and/or the related subscription documents before making a commitment. The recipient also must consult its own legal, accounting and tax advisors as to the legal, business, tax and related matters concerning the information contained in this document to make an independent determination and consequences of a potential investment in a fund, including US federal, state, local and non-us tax consequences.

Past performance is not indicative of future results or a guarantee of future returns. The performance of any portfolio investments discussed in this document is not necessarily indicative of future performance, and you should not assume that investments in the future will be profitable or will equal the performance of past portfolio investments. Investors should consider the content of this document in conjunction with investment fund quarterly reports, financial statements and other disclosures regarding the valuations and performance of the specific investments discussed herein. Unless otherwise noted, performance is unaudited.

Do not rely on any opinions, predictions, projections or forward-looking statements contained herein. Certain information contained in this document constitutes “forward-looking statements” that are inherently unreliable and actual events or results may differ materially from those reflected or contemplated herein. Upper90 Capital Management does not make any assurance as to the accuracy of those predictions or forward-looking statements. Upper90 Capital Management expressly disclaims any obligation or undertaking to update or revise any such forward-looking statements. The views and opinions expressed herein are those of Upper90 Capital Management as of the date hereof and are subject to change based on prevailing market and economic conditions and will not be updated or supplemented.

External sources. certain information contained herein has been obtained from third-party sources. Although Upper90 Capital Management believes the information from such sources to be reliable, Upper90 Capital Management makes no representation as to its accuracy or completeness.

This document is not intended for general distribution and it may not be copied, quoted or referenced without the Upper90 Capital Management's prior written consent.